Bixby's Sparking Curiosity Fund

Thank you for making an unrestricted gift to the Sparking Curiosity Fund. Every gift, regardless of size, makes a big difference.

To make a one-time or recurring gift using a credit card, please click here!

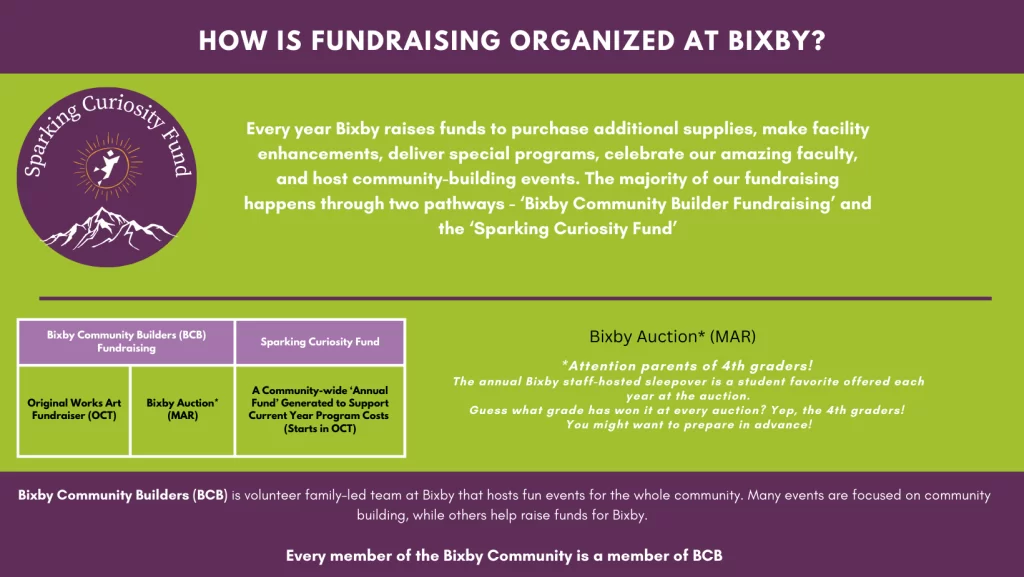

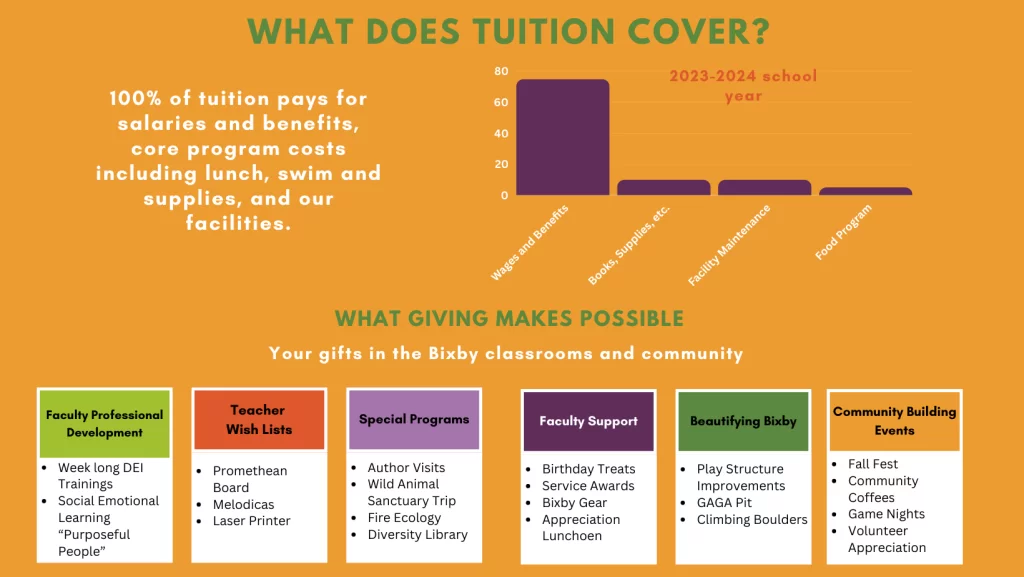

Bixby’s Sparking Curiosity Fund is an annual fundraising event. Gifts to the fund help fund the current school year and support our programming, competitive salary for teachers, and student experiences. You can find out more about how your support helps at our Philanthropy Overview.

Other giving opportunities are distributed throughout the year, including fun, community-building events like the Book Fair, Original Works, and the spring auction. Smaller campaigns for major programs or facility needs are run on limited occasions.

Colorado Child Care Tax Credit

Bixby School benefits from the Colorado Child Care Contribution Tax Credit, as licensed childcare provider. This program provides a 50% state tax credit to Colorado taxpayers on cash donations of $100 or more specifically dedicated to supporting early childhood education at Bixby. In addition to the state tax credit, your gift remains eligible for a federal income tax deduction, making it a powerful way to support Bixby while maximizing your tax savings.For more information, follow this link: Colorado child-care tax credit program.

Additional Ways to Give

Donate by Mail

Checks should be made payable to Bixby School.

Attn: Development

Bixby School

4760 Table Mesa Drive

Boulder, CO 80305

Matching Gifts

Many employers offer matching gift programs to their employees. Matching gifts are a great way to support Bixby School and amplify your charitable giving. Contact your employer to find out more about your company’s matching gift program benefits.

Gift of Securities

Gifting securities is a great way to have impact and reduce your tax obligation for capital gains. When you make a gift of securities such as stocks, bonds, and mutual funds, you receive a tax deduction based on the value of the securities on the day of transfer, without paying tax on any increase in that value from the date you first acquired the securities.

Please notify our Director of Finance and Operations for more information.

Required Minimum Distributions

A gift to Bixby School can be a great way to reduce required minimum distributions (RMDs) and optimize the tax benefits of giving. Qualified distributions allow donors age 70 1⁄2 and older to make tax-free donations directly from an IRA to a qualified non-profit, potentially satisfying all or part of the annual RMDs without recognizing it as income for that year. Please consult with your tax advisor to see if your gift might qualify.

Planned Giving

A gift to Bixby School in your will or living trust is a simple way to have a lasting impact on Bixby students and teachers. For more information about planned giving, please contact Danielle @development@bixbyschool.org.

Ready to Donate?

If you are ready to donate, click HERE to donate online. Are you interested in donating stock or your RMD? Contact development@bixbyschool.org.